Sound bites are great. They’re short. They’re catchy. They make great headlines. And they’re rarely the entire story. As a matter of fact, they’re meant to not be the whole story, but to have enough of a sensational or curiosity-generating effect that we read on. You’re probably hearing sound bites about the market that could be considered down-right misleading.

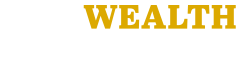

“The Market is Up.” That’s a great sound bite and when the Large Cap S&P 500 is showing a Month-to-Date return of 4.8% and a Year-to-Date loss of only 5.0% in the midst of a pandemic, then it sounds encouraging (through 5/31/20; source Morningstar). But this sort of key-hole analysis (the idea that you can look into a room through the keyhole of a door and think you can understand the whole room) is arguably one of the riskiest investing behaviors.

Let’s look at this and wrap our heads around it…

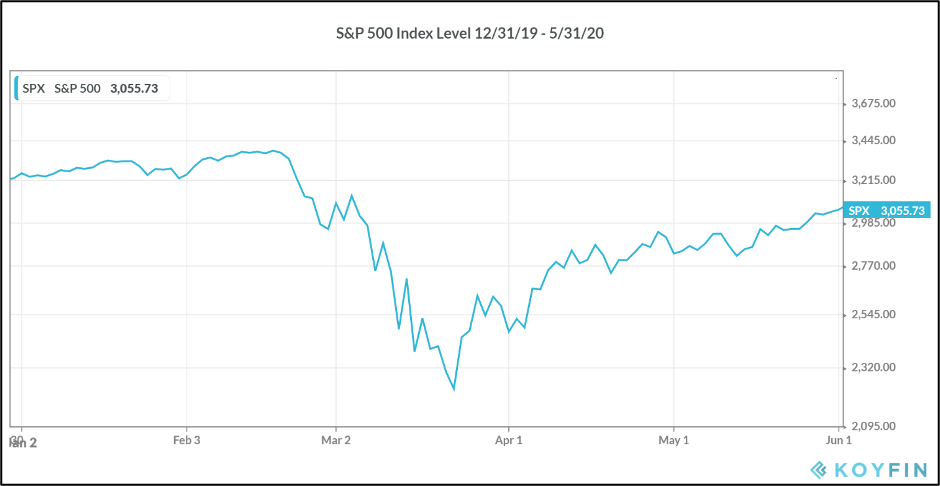

We have been in a pandemic for many weeks. We saw the fastest 30% decline in the S&P 500 history (source Bank of America Securities). Tens of millions are out of work. There is increasing turmoil in China and the US is in the grip of protests from coast to coast. Oil went negative, March was “The Craziest Month In Stock Market History,” and the Federal Reserve is taking unprecedented actions.

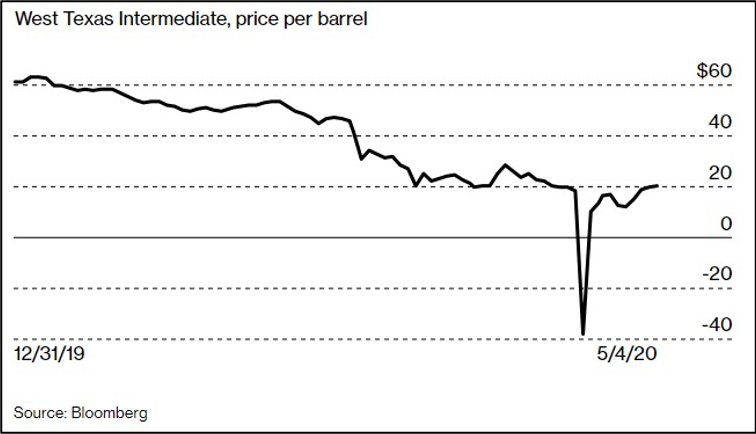

When we hear things like, “The Market is Up,” it’s worth understanding what’s actually being said. Here’s something interesting to know. The S&P 500 is dominated by tech companies, what one writer recently termed the “FAAAM” stocks (Facebook, Alphabet (Google), Amazon, Apple, and Microsoft). About 21% of the S&P500 Index is accounted for by these 5 businesses. They also are responsible for almost half of the returns in both the last 3 years, and the last 5 years.

So is the market up? More accurately, parts of the market are up. The problem with saying that is that it doesn’t make a very sensational headline during a pandemic. But it’s far more accurate and points the way toward prudent behavior. The FAAAM companies are up, but if you removed their contribution to the S&P 500 Index, it would be a completely different story.

The market has been dramatically unpredictable, and in some cases making no sense at all. The world is reeling from a series of destabilizing events. With a focus on long-term plans, what should one do?

One should work the plan, not the market.

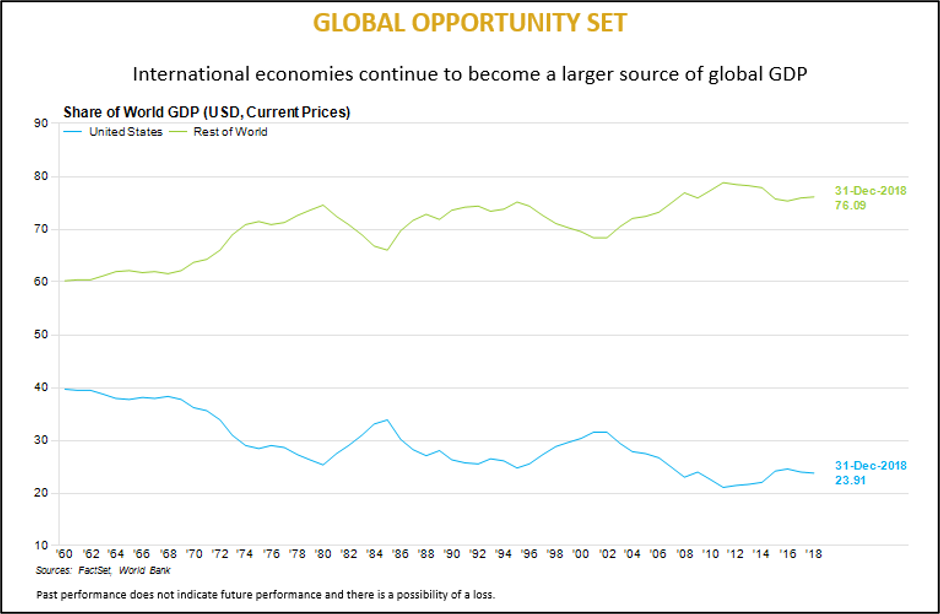

Our advice has been, and remains, to take a conservative stance and progressively introduce risk while staying very diversified. Global opportunities remain more attractive and we’re continuing to pursue them, while we certainly are keeping our eye on domestic opportunities.

It would be tempting to add a thinly-veiled lecture about Fear And Greed as the motivators of the market, but there’s a more important message to share, and that’s this: the decisions that are made about your investments should be made based on the vision you have for the future. This is about getting to your destination, about arriving at a desired future state and that’s something that is clearly articulated in a financial plan. If you have done this planning with us, this is a good time to revisit that vision and confirm that is still what you want. Because your financial plan is aimed at helping you get there.

If you don’t have a financial plan, we should chat. In the absence of a clear destination it is difficult for anyone to know if they’ve been successful, if they’ve been wise, and if they’ve won the game that matters.

Work the plan, not the market.

Past performance is not a guarantee of future results. This content is for informational purposes and is not intended as actual investment advice. Benchmark and index performance results do not represent any managed portfolio returns. An investor cannot invest directly in a presented index, as an investment vehicle replicating an index would be required. An index does not charge management fees or brokerage expenses, and no such fees or expenses were deducted from index performance shown. The S&P 500 TR USD index is a market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the U.S. stock market. TR (Total Return) indexes include daily reinvestment of dividends.