We want to take a moment to update you on our thoughts related to the recent volatility in financial markets. As we write this communication, the world is focused on Covid-19 (coronavirus) and how to stay safe and take care of our loved ones. We are seeing more companies require employees to work remotely, universities and local school systems moving to virtual learning, and the cancelation of athletic and entertainment events.

MKD and our partners including Fidelity Investments have contingency plans in place. We have the good fortune of being able to leverage technology to do our work remotely and practice social distancing. We are only a phone call or email away.

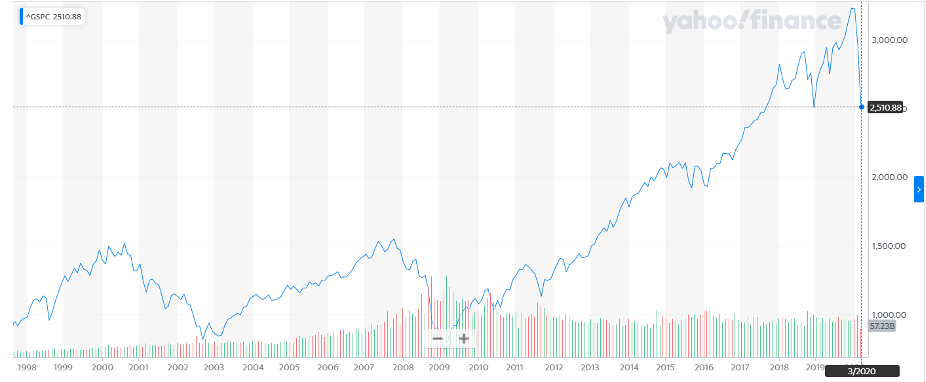

The stock market has been in a “risk on” environment for a number of years during the longest bull run in history. 2019 returns appeared to be gasoline on a white-hot market. Coming into 2020, we remained concerned about valuation levels and where appropriate, favored conservative decisions over aggressive. From the perspective of valuation, not much has changed since the peak of the stock market on February 19th until now. Earnings expectations are beginning to be adjusted downward to account for the slowdown of economic activity.

Covid-19 coupled with the oil price war between Saudi Arabia and Russia have been the recent catalyst for volatility. As of this writing, the S&P 500 is off over 25% from the highs and testing the lows of the 2018 4th quarter correction.

While this poses a 25% better buying opportunity than just a few weeks ago, the philosophy of “buy the dips” has shifted to “sell the rallies” which is why stocks are having a hard time moving higher.

If you are experiencing fear when seeing declines in your portfolio, this is normal and understandable. Keep in mind that in the short term, market movements can be heavily influenced by fear and computerized trading, while in the long term, they tend to reflect broader-based economic trends. As investors, the challenge is to not let the difficulties of the short-term prevent us from reaping the potential benefits of sound, long-term investing.

We thought it would be a good time to relook at our three investment principles:

- GOAL ACHIEVEMENT IS WHAT MATTERS

- Goal clarification determines portfolio construction

- Family Index is your personal benchmark

- MOST IMPORTANT TO STICK WITH THE PLAN

- Strategies work over time, not all the time

- There is not “the way” to invest – all strategies will feel good/bad at some point

- Create a plan with the highest probability of sticking with it

- INVESTING DECISIONS ARE BASED ON A PROCESS

- Emotionless

- Successful investing does not require the ability to predict the future

- Decisions manage risk, not returns

Thoughts moving forward:

- Interest rates will likely move toward zero with big swings along the way.

- Stocks are likely to see continued volatility both up and down.

- It is too soon to tell if the decline in economic activity will kick off a global recession or if the economy will shake off this action. Watching the recovery in China and South Korea may provide clues as to the duration for the US and Europe.

- It is also too soon to say if this is a good buying opportunity in the stock market.

- Prudent principles of long-term investing will get us through this phase. “This too shall pass.”

We will continue to monitor the unfolding events and recommend actions as appropriate. Please reach out with any questions about your specific situation. Thank you for your continued trust and confidence.

We at MKD Wealth Coaches are wishing you and your family peace and good health.